Ytd federal withholding calculator

1547 would also be your average tax. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

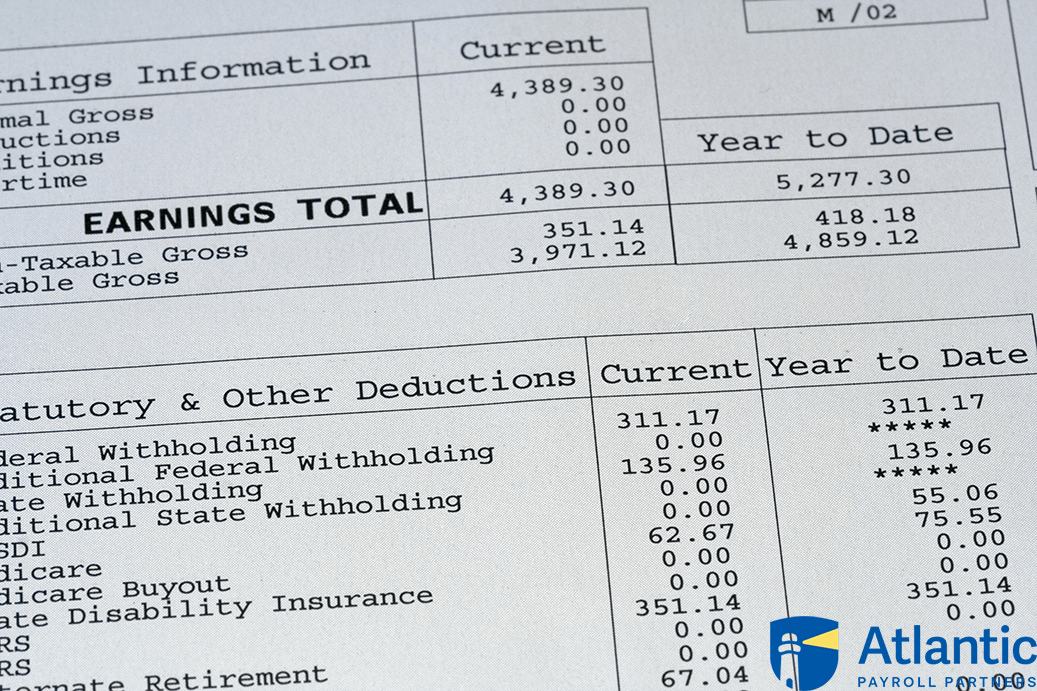

How To Read Your Pay Stub Asap Help Center

Urgent energy conservation needed.

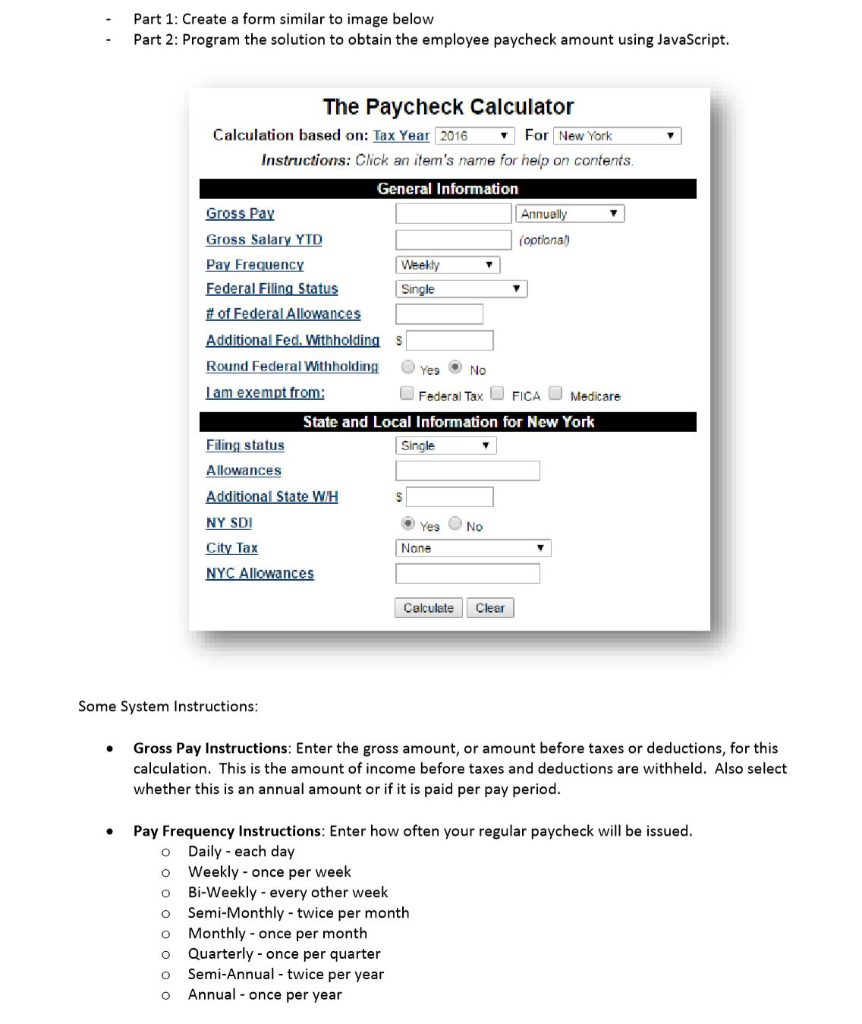

. Federal taxes were withheld as if I worked 80 hours in one week almost 40. Subtract 12900 for Married otherwise. A paystub generator with YTD calculator.

Prior YTD CP. Federal taxes were withheld as if I worked 80 hours in one week almost 40. Enter Employee Details like Name Wages and W-4 information.

2022 Federal New York and Local. IRS tax withholding calculator question. Free Federal and New York Paycheck Withholding Calculator.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. IRS tax withholding calculator question. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

10 12 22 24 32 35 and 37. 2022 W-4 Help for Sections 2 3 and 4. The amount of income tax your employer withholds from your regular pay.

This online calculator is excellent for pre-qualifying for a mortgage. Exemption from Withholding. 10 12 22 24 32 35 and 37.

YTD federal income tax withholding can be entered in the W2 box. ESmart Paychecks free payroll calculator is a paycheck calculator that can be used to calculate and print paychecks and paystubs. The tax calculator asks how much federal taxes am I paying ytd.

Free Federal and Illinois Paycheck Withholding Calculator. Federal Income Tax Withheld NA. How It Works.

Ad Get the Latest Federal Tax Developments. Enter Company Details like Name EIN Address and Logo. But on my paystub I only see federal income tax and SSMedicareNy income.

2022 W-4 Help for Sections 2 3 and 4. 2020 Federal income tax withholding calculation. Raise your AC to 78 from 4pm - 9pm.

Estimate your federal income tax withholding. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. A pay stub should also list deductions for both this pay period and the YTD.

Free Federal and Illinois Paycheck Withholding Calculator. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. The tax calculator asks how much federal taxes am I paying ytd.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Free Federal and New York Paycheck Withholding Calculator.

Free Federal and New York Paycheck Withholding Calculator. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. Ad Get the Latest Federal Tax Developments.

Instead you fill out Steps 2 3 and 4 Help for Sections. Switch to Arkansas hourly calculator. The tax calculator asks how much federal taxes am I paying ytd.

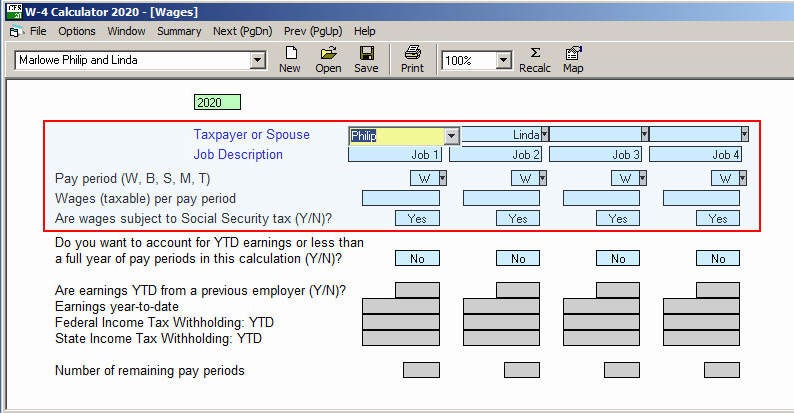

For employees withholding is the amount of federal income tax withheld from your paycheck. 2020 brought major changes to federal withholding calculations and Form W-4. Use this tool to.

See how your refund take-home pay or tax due are affected by withholding amount. Or the results may point out that you need to make an estimated.

Us Enter Year To Date Ytd And Current Amounts Wagepoint

Filing Status Instructions Select Your Filing Chegg Com

Payroll Taxes Aren T Being Calculated Using Ira Deduction

What Does Ytd On A Paycheck Mean Quora

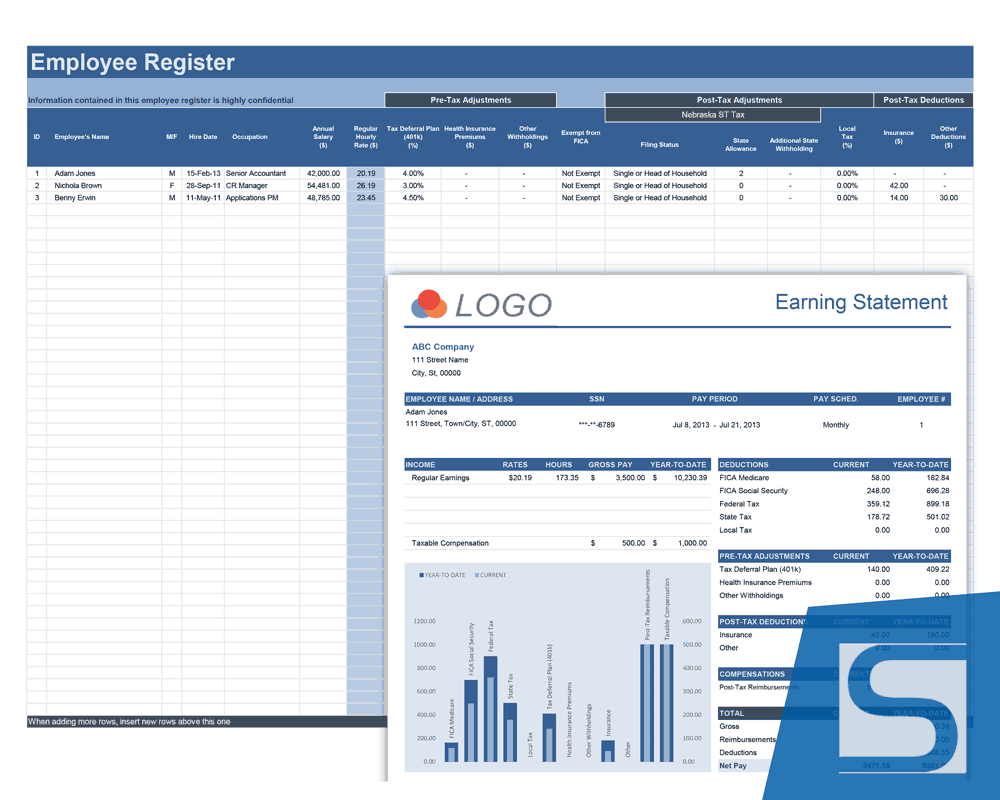

Payroll Calculator Free Employee Payroll Template For Excel

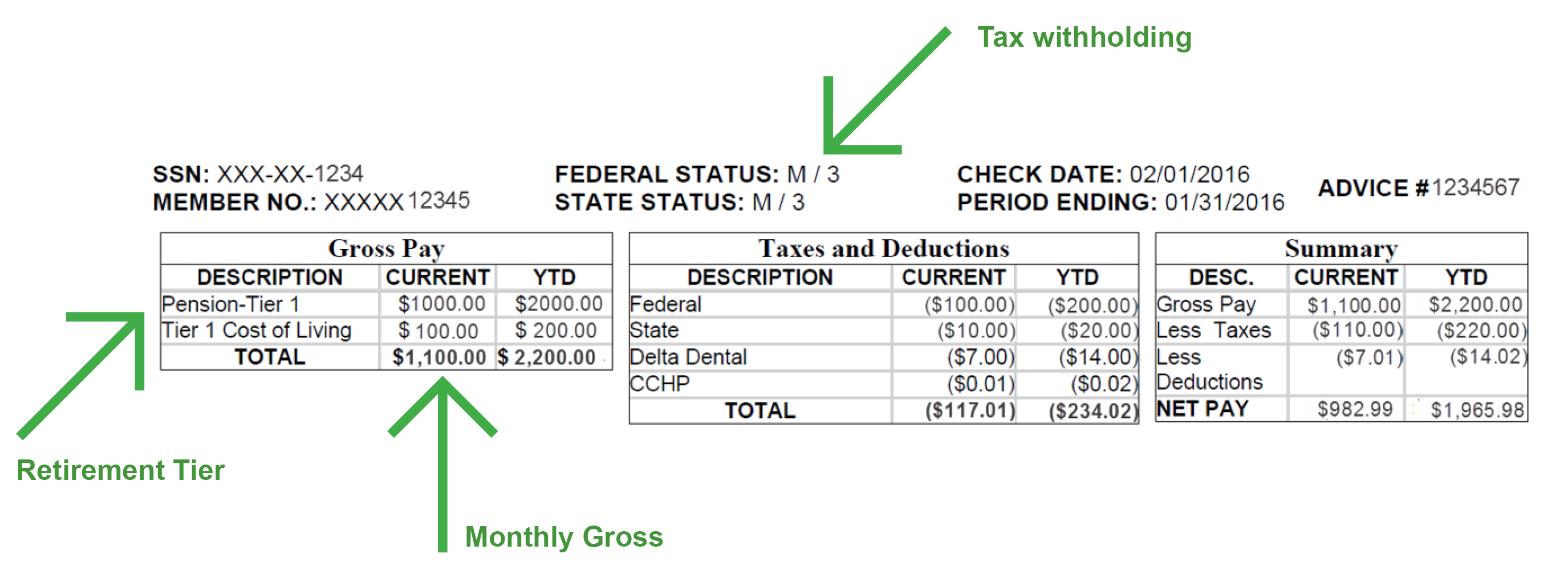

Benefit Advice Notice Contra Costa County Employees Retirement Association

Payroll Calculator Free Employee Payroll Template For Excel

Hrpaych Yeartodate Payroll Services Washington State University

W 4 Calculator Cfs Tax Software Inc

Paycheck Calculator Online For Per Pay Period Create W 4

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Peoplesoft Enterprise Global Payroll For United States 9 1 Peoplebook

Payroll Calculator Free Employee Payroll Template For Excel

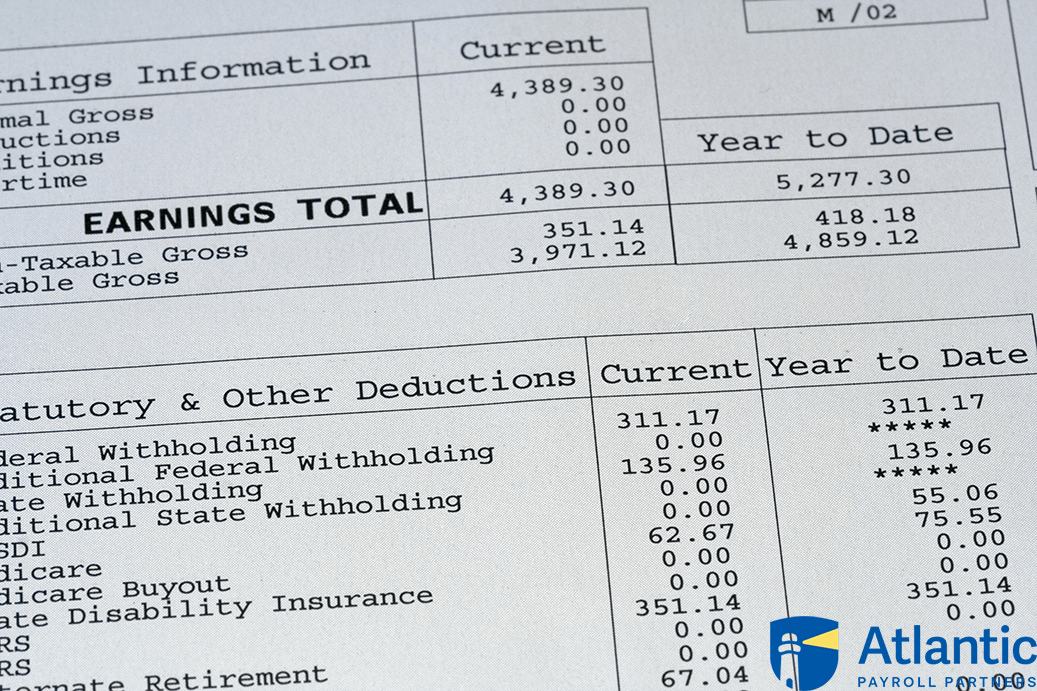

How To Calculate Net Pay Atlantic Payroll Partners

Decoding Your Paystub In 2022 Entertainment Partners

Tax Information Career Training Usa Interexchange